Government Liable for Flooding of Upstream Properties during Hurricane Harvey

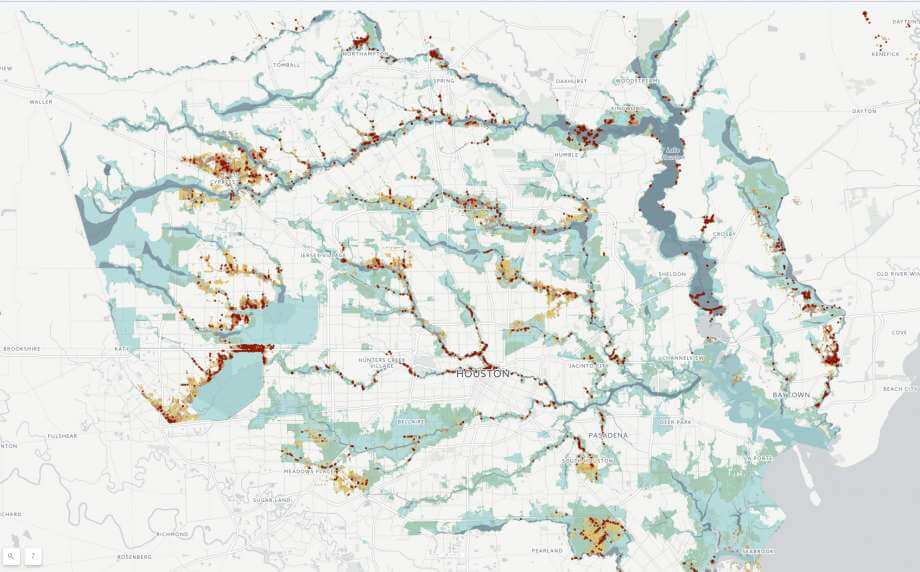

On December 17, 2019, Judge Charles Lettow of the U.S. Court of Federal Claims entered an order and opinion that “the government’s actions relating to the Addicks and Barker Dams…