When a hurricane causes damage to a property, one of the first things owners should do is file an insurance claim. While filing a claim can bring some relief to commercial property owners looking to recover as quickly as possible, insurance policies related to hurricane damage are often incredibly nuanced and may exclude even the most catastrophic damage. In these instances, it is important that commercial property owners know what is covered under their hurricane insurance policies.

Hurricanes vs. Tropical Storms

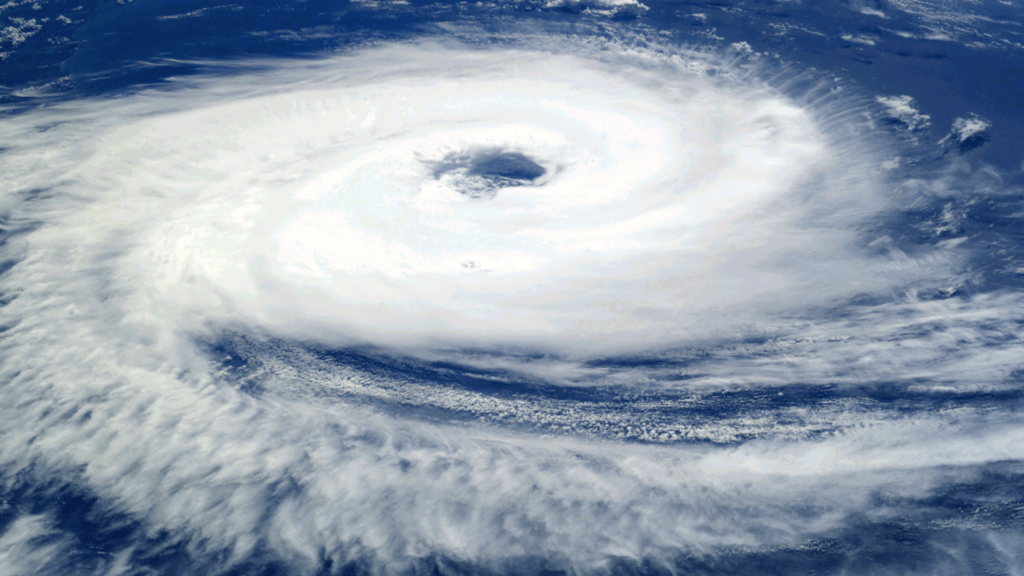

Commercial properties suffer major losses due to hurricanes and tropical storms each year. Both hurricanes and tropical storms start as tropical depressions. Sometimes referred to by meteorologists as a tropical wave, tropical disturbance, or tropical system, tropical depressions are defined as having cyclones with winds of up to 38 miles per hour or less. Despite having a cyclone, these systems are not as strong as those that form in a hurricane, which can spawn tornadoes. Tropical storms can still generate significant amounts of rain, thunderstorms, and devastating flood activity.

Tropical storms can produce large amounts of rain and can create enough wind and wave activity to cause damage to boats and erode beaches. From this point, meteorologists will begin to categorize these systems according to the Saffir-Simpson Hurricane Wind Scale. The scale rates storms on a 1 to 5 category rating that measures sustained wind speed. Once the winds of a tropical storm reach 74 miles per hour, it is classified as a Category 1 hurricane.

Once a storm has sustained winds of over 74 miles per hour, a distinct spiral arrangement of thunderstorms with a low-pressure center is formed, creating a hurricane. Also known as a typhoon in the Pacific Ocean, hurricanes are the most dangerous and devastating type of tropical system. The Earth’s rotation causes these systems to accelerate toward the poles if the ocean’s current doesn’t steer them. According to the Saffir-Simpson Hurricane Wind Scale, hurricanes that reach a Category 3 or higher are considered to be “major” due to their potential to cause significant damage and loss of life.

Commercial Insurance Coverage for Hurricane Damage

Commercial properties, particularly those in coastal areas, can suffer major losses due to hurricanes and tropical storms each year. While these events are not uncommon, there can be a lot of confusion when it comes to filing an insurance claim for hurricane-related damage. For starters, hurricane damage is not covered under one policy, rather, hurricane insurance consists of multiple policies outside a standard property policy. These typically include windstorm, flood, commercial property, and business interruption coverage. However, even with these policies in place, not all loss amounts will be covered to the same degree or even at all.

There are a few ways hurricane-related damages can be covered by various insurance policies depending on the property’s location and insurance provider, such as:

- All Peril: All peril is the most comprehensive coverage, and insures everything except that which is specifically excluded within the policy.

- Named Peril: Named peril coverage will cover only what is specifically denoted in the policy. This is usually less expensive, as it offers far less coverage.

Even though comprehensive hurricane insurance coverage for commercial properties must often be accomplished by purchasing multiple different policies in order to address the full spectrum of needs, it is ultimately up to the policyholder to ensure property coverage is adequate. To determine this, it’s important to look at what typically is and isn’t covered when it comes to hurricane-related damages.

What May Be Covered

Typically, with combined commercial property, business interruption, windstorm, and flood insurance policies, business owners should anticipate the following will be covered in the event of a hurricane:

- Buildings and Structures: When a hurricane causes property and structural damage, that portion of the loss is generally covered. This includes office buildings, production facilities, and other business structures.

- The Contents of the Property: Most standard commercial insurance policies will cover the contents inside of the property, including furnishings, fixtures, computers, electronic equipment, and other items within the interior damaged by a hurricane. Despite this, more specialized types of equipment and property stored in the property may not be covered unless additional coverage has been purchased.

- Product Inventory and Cargo: If a business relies on transporting products to consumers, having hurricane-damaged inventory and cargo can be devastating to its bottom line. Because of this, most policies include coverage for inventory and cargo that becomes damaged or compromised due to a storm or hurricane.

- Equipment and Machinery: Machinery, vehicles, aircraft, tools, and equipment can all be damaged in a hurricane. The coverage for these losses is not always equal. Commercial vehicles can be covered by one policy, while specialized equipment may be covered under another. Because of these discrepancies, commercial property owners must ensure they carry additional coverage for specialized machinery or contractor equipment on the property.

- Flood Damaged Property: Under private policies or through the National Flood Insurance Program, commercial property owners can ensure coverage for flood-related property damage.

- Business Closures: If a commercial property suffered hurricane damage that left the building inoperable for some time, obtaining a separate business interruption policy can help cover the cost of wages, lost revenue, and other overhead and operational expenses. When triggered, this coverage allows business owners to recoup the funds lost due to the premises being inoperable following physical damage, usually after a 72-hour interim waiting period.

What May Not Be Covered

With just a standard commercial property policy in place, some items may not be covered in the event of hurricane damage, including:

- Wind Damaged Property: This is where hurricane insurance can get complicated. Wind-damaged property can only be covered under a windstorm policy. This is true for hurricane-prone areas like Texas, Louisiana, and Florida, where hurricane and tropical storm strength winds can be incredibly strong and cause massive amounts of damage. Thus, an additional windstorm policy will need to be purchased.

- Flooding and Storm Surge: Just like with wind-related damage, flood damage caused by a hurricane can only be covered by purchasing a separate flood policy. This is also true for any flooding that occurs due to a hurricane’s storm surge.

- Mudslides: Certain areas of the country are prone to mudslide activity after major storms and hurricanes. Unfortunately, mudslides are typically categorized like earthquakes – as earth movement events – which are not covered under a standard commercial property, windstorm, or flood policy.

Commercial property owners must remember that the specific terms of each insurance policy can be different. Because of this, obtaining the proper coverage for a property can be a complex and cumbersome task. Policyholders should regularly review their commercial, flood, windstorm, business interruption, and other specialized policies to ensure their coverage is current and adequate for all potential losses by consulting with a lawyer who focuses their practice on claims involving commercial property hurricane insurance coverage.

Hurricane Deductible Reimbursement Policies

A hurricane deductible applies to property damage caused by storms categorized as hurricanes by the National Weather Service or U.S. National Hurricane Center. Just like health insurance, a hurricane deductible is the amount of money the insured must pay toward their loss before the insurance company’s obligation to pay kicks in. The specific terms of your agreement are often laid out in the commercial property owner’s insurance policy.

However, this type of deductible only applies in certain situations dictated by the terms of the insurance policy. The insured’s responsible portion is generally calculated as a percentage of the property’s total insured value. And most hurricane deductibles work the same way: when a named storm damages property, the insured will be responsible for paying the first one to five percent (or more) of the claim before coverage takes over.

Some property owners may qualify for an additional insurance product called a hurricane deductible reimbursement policy. These policies are designed to cover the high costs of hurricane deductibles and thus ideally eliminate out-of-pocket expenses for the insured in the event of a hurricane-related loss. The best available versions of these policies afford property owners in high-risk areas first-dollar coverage in the event of a natural disaster.

How Long Will a Hurricane Insurance Claim Take To Resolve?

The length of time a hurricane insurance claim takes to resolve often depends on factors including which insurance company you have as well as the type and extent of the damage. Typically, claimants have to wait two to three days before getting a response from an insurance provider after filing a claim for property loss. However, because hurricanes are large, wide-spanning natural disasters, the average wait time for a response is likely to be much longer due to the high volume of claims – sometimes taking two weeks or longer.

Some states have laws in place that mandate insurers respond to policyholders in compliance with specific requirements and timeframes after receiving written notice of a claim. In Texas, the Texas Prompt Payment of Claims Act (TPPCA) requires an insurer to (1) acknowledge receipt of the claim; (2) begin an investigation of the claim; and (3) request from the policyholder all documentation necessary to secure final proof of loss. If the insurer’s acknowledgment is not done in writing, the insurer must make an internal record of the date and content of the acknowledgment. An insurer licensed in Texas has 15 days to do this, while an eligible surplus lines insurer has 30 business days. As part of an investigation of the claim, an insurer may send an adjuster to come and inspect the property for damage. This visit and assessment can occur anywhere from three days to a week after the policyholder’s initial contact with the insurer.

Once the insurance company and the insurer have received all necessary information required to investigate the claim, including the adjuster’s report, the insurance company has an additional 15-day period to notify the policyholder whether the claim has been accepted or denied. In the event the claim is denied, the insurer must provide valid reasoning for the denial. On the other hand, if the carrier is unable to accept or reject the claim within 15 days, it must notify the claimant and provide reasoning for needing more time. The insurer can be granted 45 more days to meet this initial deadline. If the claim is accepted, it must be paid within five business days. In Texas, the insurance company is required to pay a claim within 60 days after receiving the requested items from the policyholder. If the claim is not paid within the 60-day timeframe, the insured is entitled to not only the payment of the claim but also statutory damages of up to 18 percent interest per year and attorneys’ fees.

Commercial Property Hurricane Insurance Claim Attorneys

When a hurricane threatens a business and its property, business owners may assume they are protected in the event of property damage if they have a commercial insurance policy in place. Unfortunately, this isn’t always the case, as many insurance companies deny, delay, or underpay valid claims in bad faith. The experienced team of trial attorneys at Raizner Slania is well-versed in the tactics insurers use to pay less than their insured is owed. If your commercial property has been impacted by a hurricane and you need assistance with a claim, we can help.