When the roof of a commercial property is damaged, it can make for costly repairs and the potential loss of business. Roofing systems are a major investment for business owners, making any damage they sustain incredibly frustrating. In these situations, not only can the exterior of the property be impacted, but the interior can quickly become compromised as well. Before the unexpected can happen, commercial property owners need to ensure they have proper insurance coverage and know the steps to take to file a claim for roof damage.

How to File a Claim for Roof Damage For Your Commercial Property

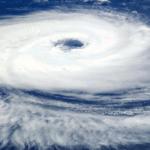

Commercial properties are a major investment for their owners, making it especially frustrating when they become compromised due to unexpected roof damage. No matter if the damage is due to a hail storm, hurricane, or another natural disaster, owners must file a timely and accurate commercial property damage claim for roof damage to ensure an expedient repair and proper compensation. The steps to take to properly claim roof damage for your commercial property include:

Document the Damage

When a commercial property owner has discovered roof damage is present at their property, one of the first things they should do is document the damage and complete an inspection of the roof. This includes taking photos and videos of the damage and noting any pertinent details. It can also be helpful in these situations to have proof of the roof’s condition before the event that caused the damage. This way it will be much easier to show the insurance company that the damage was due to an unanticipated event, rather than wear and tear.

To complete the inspection of the roof, it is often in the best interest of the business owner to have an experienced roofing contractor inspect the damage to make the process as smooth as possible, without compromising physical safety.

File the Claim With the Insurance Company and Make Temporary Repairs

Once the roof inspection is complete, an insurance claim should be filed as quickly as possible to protect the property from further damage and to put the carrier on notice. While the claim is being reviewed, commercial property owners can make temporary repairs to help protect the already damaged areas and ensure other portions of the property will not be subject to further damage. However, during this phase, the repairs made mustn’t be permanent. Making permanent repairs before the claim has been fully processed, can lead to claim denial and could leave property owners footing the repair bill on their own. Temporary repairs that can be made include securing a tarp over the roof and blocking off the already damaged areas of the property from the rest of the business to contain the damage.

Have an Adjuster Inspect the Damage

Once a claim is filed, the insurance carrier will send its own claims adjuster to the site to perform an inspection. During this inspection, commercial property owners and their roofers will discuss their conclusions directly with the claims adjuster.

Insurance adjusters work primarily for the benefit of the insurance companies that pay them and may go out of their way to attempt to blame the damage on anything but the covered event that caused it. For instance, an adjuster may review roof damage and come back with a finding that the damage was due to regular wear and tear rather than a hail storm. Instances of wear and tear are generally not covered by commercial property insurance and so this can lead to wrongful claim denial.

Damages Not Covered by Commercial Property Insurance

There are a variety of scenarios that could make certain damages unlikely to be covered by an insurance policy, including:

Leak and Water Damage

Water damage, including leaks, is only covered if the damage was caused by a covered event. For instance, if a hailstorm damaged your roof, which resulted in a leak, that damage would be covered.

Insurance policies will generally not cover water damage to a roof if hail or wind damage is not covered by the existing policy if a leak develops over time due to gradual wear and tear, or if the roof has not been properly maintained.

Roof Age

A roof damage claim may not be covered if the roof is too old. In most cases, “old” means 20 years or older, which accounts for the lifespan of most shingle roofs.

The roof of a commercial building can also be deemed too old if one of the lower layers is 20 years old and a new layer was added to it rather than having the whole roof replaced.

Damage Caused By Property Owner

If the property owner damages their roof, the claim will likely not be covered under their insurance policy.

Property owner damage can occur in the form of water damage due to wear and tear or attempting to self-repair the roof and only damaging it further.

Financially Risky Materials

Certain roofing materials that are highly expensive and/or can be easily damaged are likely not covered by insurance.

Materials like wood burn easily and thus may not be covered. Expensive metal roofs can be damaged by hail. Slate roofs are incredibly heavy and costly to install, meaning they are likely not to be covered.

Excluded Perils

While covered perils account for most weather events that will likely cause damage to a building’s roof, several perils are generally excluded, including:

- Flooding

- Earth movements, such as earthquakes, landslides, mudslides, or sinkholes

- Mold and mildew, except in certain instances

- Pest infestation

- Sewer backup

- War or government action

- Nuclear leak or explosion

Commercial Property Claim Denials

Commercial property damage can be incredibly devastating for both building owners and their tenants. Commercial property insurance may be costly, but it is crucial – and in many cases required – to protect the livelihood of the business or businesses operating out of the premises.

Insurance companies can deny, delay, or underestimate the value of a commercial property damage claim. If the property’s roof has sustained damage covered by the current policy, but the insurance company won’t pay the claim, the business owner should enlist the help of an experienced commercial insurance claims attorney.

Commercial Property Insurance Claim Attorneys

Damage done to the roof of a business can be detrimental to ongoing day-to-day operations. At Raizner Slania LLP, we understand this frustration and that dealing with a commercial property damage claim can hurt the livelihood of the business. If you are a property owner needing assistance with commercial roof policy coverage or with a wrongfully delayed, underpaid, or denied roof property damage claim, we can help.