Raizner Slania LLP has filed an insurance lawsuit on behalf of a Caddo Parish, Louisiana commercial property owner (“Plaintiff”) against Mt. Hawley Insurance Company (“Defendant”). The lawsuit was necessary due to the unreasonable denial of Plaintiff’s hailstorm damage claims.

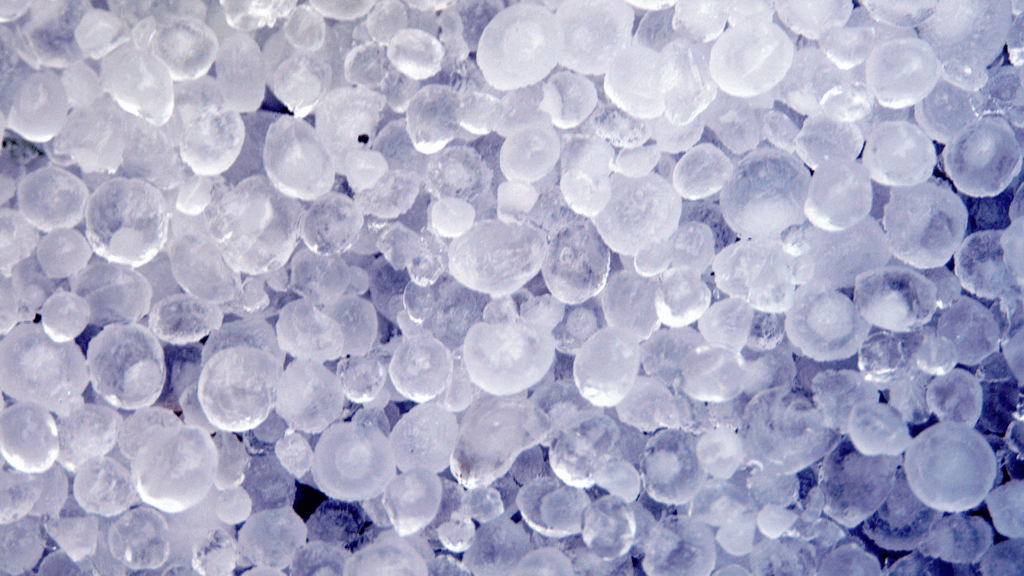

Hailstorm Damages Commercial Property

The allegations in the petition are as follows:

On or about April 29, 2020, a severe hailstorm hit the Plaintiff’s property, causing significant damage. Immediately following the storm, Plaintiff submitted a claim with Defendant, alerting them to the hailstorm damage and the loss covered under the policy.

The Defendant retained the adjusting firm Engle Martin & Associates, who processed the Plaintiff’s claim for benefits. The Defendant also assigned engineer Brian Sattler of EFI Global to inspect the property and report his findings. During his inspection, Plaintiff’s professional consultants made sure to specifically identify the significant damage to the property’s roof systems, HVAC units, and lights. The Plaintiff’s consultants also told him of the various interior damages and leaks caused by the hail, but he did not request to see it.

Sattler’s report included data that there was a high probability hail ranging up to 1.75 in diameter near the property. Defendant’s consultant recognized the damages to the subject property. However, the Defendant ignored all evidence of covered damages provided by both the Plaintiff’s and the Defendant’s own retained consultants and subsequently denied Plaintiff’s claim.

The denial letter parroted much of the language from Sattler’s report but failed to mention the Benchmark Hail History Report regarding the hail in the area. On November 6, 2020, the Plaintiff sent the Defendant a sworn statement of partial proof of loss, outlining in detail the extent and nature of the loss sustained. The Defendant rejected the proof of loss on November 10, 2020 and has paid nothing to date.

The Insurance Carrier Acted in Bad Faith

In addition to the actions mentioned herein, the Plaintiff specifically alleges the Defendant violated Louisiana insurance law by:

- Failing to pay the claim or make a written offer of settlement within the applicable statutory period of 30 days after the receipt of such loss

- Willfully disregarding substantial evidence of hail damage

- Willfully disregarding meteorological evidence of significant hail damage

- Refusing to pay the claim based upon a pretextual report

Under LSA-R.S. 22:1892, an arbitrary, capricious, and without-probable-cause failure to pay benefits owed subjects an insurer to a penalty of 50% of amounts due plus reasonable and necessary attorney’s fees and costs incurred.

The Plaintiff additionally alleges the carrier breached its contract, breached its duty of good faith and fair dealing, and acted in bad faith by:

- Unreasonably and in bad faith denying benefits due under the property and casualty insurance policy.

- Unreasonably and in bad faith denying payment or settlement of claims.

- Unreasonably and in bad faith ignoring and refusing to consider information favorable to the Plaintiff’s claim for benefits due pursuant to the property and casualty insurance policy.

- Unreasonably and in bad faith refusing to pay the benefits the Plaintiff is due pursuant to the property and casualty insurance policy.

- Unreasonably and in bad faith placing its own welfare and financial interests ahead of the welfare and financial interests of the Plaintiff.

- Unreasonably and in bad faith compelling Plaintiff to institute this litigation to obtain benefits due under the property and casualty insurance policy.

- Misrepresenting pertinent facts or insurance policy provisions relating to any coverage at issue.

- Failing to pay the amount of any claim due any person insured by the contract within 60 days after receipt of satisfactory proof of loss from the claimant.

- Failing to pay claims pursuant to R.S. 22:1893 when such failure is arbitrary, capricious, or without probable cause.

Insurance Coverage Attorneys

If you are a commercial property owner whose insurance claim has been wrongfully delayed, denied, or underpaid, the insurance coverage attorneys at Raizner Law can help. Contact us today to schedule a free consultation.