From costly hail damage to a devastating water loss, a commercial property insurance plan is crucial in protecting your business from a variety of incidents; however, finding the right commercial property insurance for your business isn’t as easy as you’d think. Corruption inside commercial property insurance has left many business owners high and dry after a loss. This is particularly true in states like Texas, where the grey market surplus lines insurance industry has virtually taken over the entire market despite regulatory protections to the contrary. The best way to protect yourself from buying a bad insurance plan is to understand how, when, and why corruption happens during the insurance procurement process.

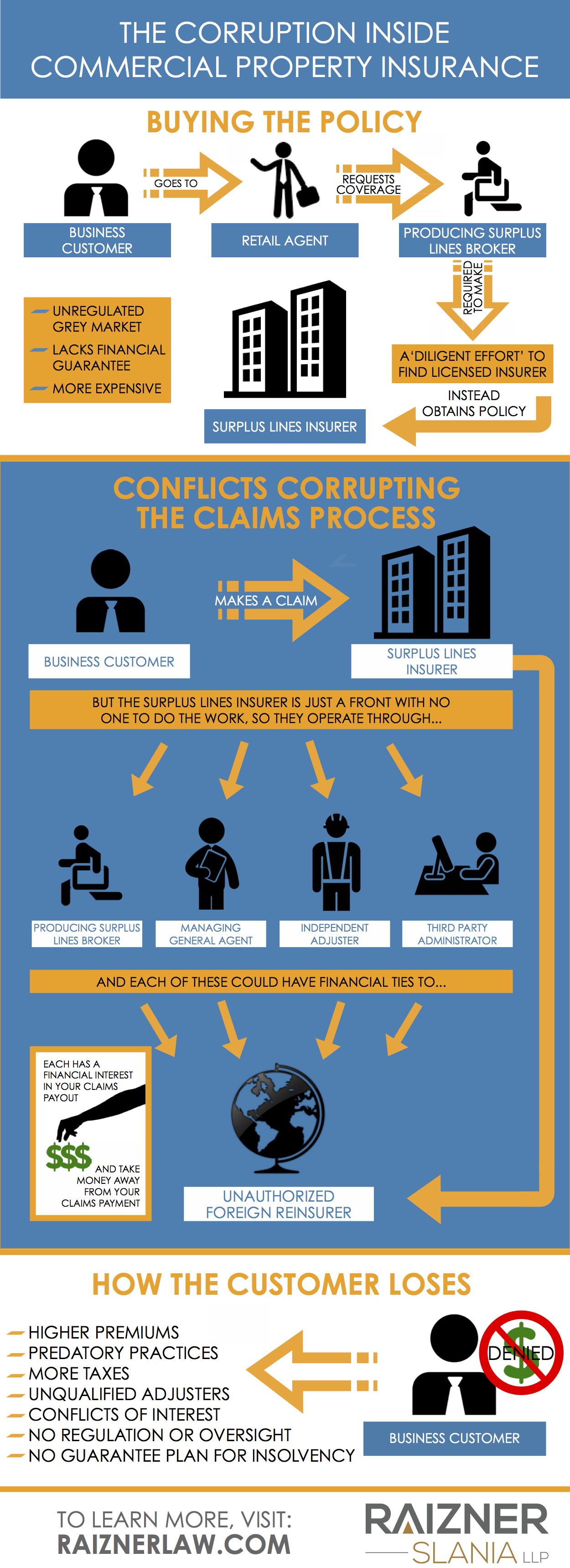

When a business owner needs commercial property insurance, they visit a retail agent, who typically is just a sales group that does not have any authority to bind an insurance company. So, the retail agent contacts a producer, typically a licensed surplus lines broker, and this producer has the authority to bind an insurer. Under the law, the producing broker must conduct a “diligent effort” to obtain insurance from a legitimate, admitted and licensed insurer. Unfortunately, due to a lack of true oversight and financial incentives, the producing broker either skips the “diligent effort” process or just gives it a superficial lip service without truly complying. The result is that the producing broker most often obtains the policy from a surplus lines insurer, which is usually more costly and is an unregulated grey market that lacks financial guarantees.

Surplus lines insurers are typically really just a front – file drawer entity –and most or all of the true insurance risk is ceded to unauthorized foreign reinsurers that are neither licensed in the state nor legally authorized to conduct the business of insurance in the state. They are little more than offshore investment schemes. Because of this, there is no one locally available to do the work on behalf of the surplus lines insurer once a policyholder files a claim under his or her policy. The surplus lines insurers must use local managing agents, independent adjusters, and third party administrators to address the claim and any one of these individuals could have financial ties back to the surplus lines insurer or even the the foreign reinsurer.

The potential for conflicts of interest under these circumstances is rampant, and this can seriously impact whether a commercial property claim is paid or denied. Because of the parasitical structure of these financial investment schemes masquerading as insurance companies, the money flows to the various entities who all have their hands in the process instead of the business insurance customer who paid their premiums and expect protection when a catastrophe occurs. Policyholders insured through surplus lines carriers are subject to predatory practices by the insurers, they pay higher taxes and premiums, get policies that are not approved by state regulators and contain far less coverage, and their claims are often evaluated by unqualified, and sometimes unlicensed, out of state adjusters.

The market for surplus lines insurers is largely unregulated and has virtually no oversight. Many business owners unknowingly purchase policies with these insurers and suffer economic hardship when their claims are later delayed, denied, or underpaid. The various insurance entities and investors profit handsomely from this grey market structure, while business policyholders are left without the protections they have paid for.

Raizner Slania: Commercial Property Insurance Lawyers

Raizner Slania is experienced in fighting insurance companies who operate in bad faith. We handle all commercial property insurance litigation on a contingency fee basis, so you owe us nothing unless we help you recover financial damages. If your commercial property insurance claim has been denied, delayed, or underpaid, call the lawyers at Raizner Slania today for a free consultation.