Raizner Law LLP has filed an insurance lawsuit on behalf of a Hidalgo County property management company against AmRisc LLC and Certain Underwriters at Lloyd’s London. The lawsuit was necessary due to an unreasonable denial of the plaintiff’s commercial property windstorm damage claim.

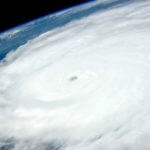

September 2018 Windstorm

On September 9, 2018, a windstorm struck the plaintiff’s property which caused significant damage to the commercial structure, including damage to building components like the roof system, interior, exterior, and more. Upon discovering the damage, the plaintiff filed an insurance claim and asked that the cost of repairs be covered pursuant to the policy. The plaintiff’s own consultant further identified dramatic damage that ruined parts of the building’s roof.

The insurance carrier (Underwriters), through AmRisc, assigned adjusters, consultants, and agents to the plaintiff’s file that were inadequate and improperly trained. Specifically, the claim was delegated to AmRisc to assign the claims to CJW and Sedgwick as the third party adjusting firms to handle the claims. AmRisc and Underwriters’ preferred adjusting company, Sedgwick, engaged Rimkus Consulting Group, Inc. engineer Pablo Anguian who performed a cursory review of the damages aimed at denying the claim. After an unreasonable and inadequate investigation of the property, Mr. Anguian recommended a complete denial of the full scope of covered damages; and thus, the plaintiff’s claim for windstorm damage was wrongfully denied.

Despite clear evidence of covered damage, Underwriters engaged in and ratified this improper claims conduct and ultimately approved a complete denial of the contractual damages. This underpayment omitted important facts, physical evidence, and meteorological data supporting the plaintiff’s claim.

The Carriers Acted In Bad Faith

Our client cites numerous violations of the Texas Insurance Code, including:

- Failure to attempt to effectuate a prompt, fair, and equitable settlement of a claim with respect to which liability has become reasonably clear

- Failure to adopt and implement reasonable standards for prompt investigation of claims

- Failure to provide promptly a reasonable explanation, in relation to the facts or applicable law, for the denial of a claim

- Failure to within a reasonable time to affirm or deny coverage of a claim to a policyholder; or submit a proper reservation of rights to a policyholder

- Refusal to pay a claim without conducting a reasonable investigation

- Misrepresentation of the insurance policy under which it affords property coverage to the plaintiff by making an untrue statement of material fact , by failing to state a material fact that is necessary to make other statements made not misleading, and by making a statement in such manner as to mislead a reasonably prudent person to a false conclusion of material fact, and failing to disclose a matter required by law to be disclosed

- Failure to acknowledge receipt of the claim

- Failure to timely commence investigation of the claim or to request from D.U.R. any additional items, statements or forms that Underwriters, Sedgwick, and Mr. Anguiano reasonably believe to be required from D.U.R.

- Failure to notify D.U.R. in writing of the acceptance or rejection of the claim not later than the 15th business day after receipt of all items, statements and forms required by Underwriters

- Underwriters delayed payment of D.U.R.’s claim in violation of the Texas Insurance Code

Plaintiff additionally alleged Underwriters breached its contract, breached its non-delegable duty to deal fairly and in good faith, acted fraudulently and with malice, and violated The Deceptive Trade Practices-Consumer Protection Act (DTPA).

Texas Insurance Coverage Lawyers

If you are a commercial property owner and your insurance claim was wrongfully denied or grossly underpaid, the Texas insurance coverage lawyers at Raizner Law LLP can help. Contact us today for a free consultation to review your case.