Raizner Slania LLP has filed an insurance lawsuit on behalf of the owner of a Harris County commercial strip center against Polomar Specialty Insurance Company (the “Defendant”). The lawsuit was necessary due to the unreasonable denial of the plaintiff’s commercial property windstorm damage claim.

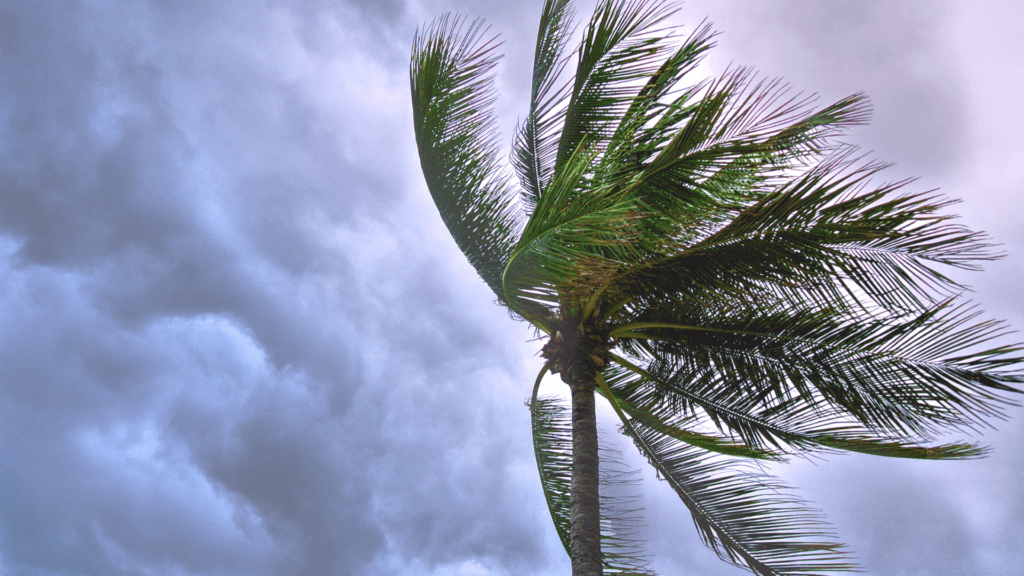

Tropical Storm Imelda Causes Significant Damage to Houston Strip Center

On September 18, 2019, Tropical Storm Imelda hit Harris County and struck the subject commercial property, which caused significant damage to the commercial structure, including sizeable portions of the property’s roof. The roof, HVAC, and exterior were substantially damaged. Upon discovering the damage, the plaintiff filed an insurance claim with Polomar.

The insurance carrier—Polomar, assigned an internal adjuster and an engineer that were improperly trained to handle the claim. Specifically, claims adjustment was delegated to Tim Mercer. Mercer engaged EFI Global’s engineer, Nar Sripadanna and both inspected the property. Sripadanna and Mercer were unqualified and incapable of adequately assessing the damages to the strip center. Polomar denied the claim after representatives stated the damage was anything but wind damage. Polomar has refused to pay for the damages covered under the policy .

Polomar’s wrongful denial omitted a wealth of facts, physical evidence, obvious wind damages, and meteorological data from Tropical Storm Imelda supporting the plaintiff’s claim. Polomar managers ratified improper claims conduct in approving the denial letter, which omitted scores of facts and meteorological data supporting the covered claim and instead unreasonably pinned the loss on anything but the wind. To this day, due to Polomar’s outcome-oriented, inadequate, and haphazard investigation, it has refused to pay for the plaintiff’s damages.

The Carriers Acted in Bad Faith

Our client cites numerous violations of the Texas Insurance Code, including:

- Failure to attempt to effectuate a prompt, fair, and equitable settlement of a claim with respect to which liability has become reasonably clear

- Failure to adopt and implement reasonable standards for prompt investigation of the claim arising under its policy

- Failure to provide promptly a reasonable explanation, in relation to the facts or applicable law, for the denial of a claim

- Refusal to pay the claim without conducting a reasonable investigation with respect to the claim

- Misrepresentation of the insurance policy under which it affords property coverage to the plaintiff, by making an untrue statement of material fact

- Misrepresentation of the insurance policy under which it affords property coverage to the plaintiff by failing to state a material fact that is necessary to make other statements made not misleading

- Misrepresentation of the insurance policy under which it affords property coverage to the plaintiff by making a statement in such manner as to mislead a reasonably prudent person to a false conclusion of material fact and failing to disclose a matter required by law to be disclosed

- Knowingly committing the foregoing acts, with actual knowledge of the falsity, unfairness, or deception of the foregoing acts and practices

- Failure to acknowledge receipt of the claim

- Failure to timely commence investigation of the claim or to request from the plaintiff, any additional items, statements or forms that Palomar reasonably believed to be required from the plaintiff

- Failure to notify the plaintiff in writing of the acceptance or rejection of the claim not later than the 15th business day after receipt of all items, statements and forms required by Defendants

- Delayed payment of the plaintiff’s claim

Plaintiff additionally alleged Polomar had breached its contract, breached its duty of good faith and fair dealing, acted fraudulently and with malice, and violated the Texas Deceptive Trade Practices Act (DTPA).

Texas Insurance Coverage Attorneys

If you are a commercial property owner and your insurance claim has been wrongfully denied or grossly underpaid, the Texas insurance coverage lawyers at Raizner Law can help you get back on your feet. Contact us today for a free consultation to review your case.