Property damage to a business can happen at any time. When the unexpected occurs, owners may find comfort in knowing they have a commercial property insurance policy on hand to account for some of the costs of repairs or relocation. However, insurance providers can deny property damage claims for many reasons and may even deny coverage for their benefit. For business owners to ensure their insurance claims are valid, it’s imperative to understand the ins and outs of the claims process and why their commercial property insurance claims may be denied.

Common Reasons Why Commercial Property Insurance Claims are Denied

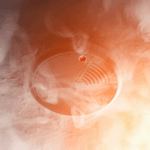

When a business suffers property damage from a fire, tornado, wind, hail, water, or other disturbance, a commercial property insurance claim should be filed. Commercial property coverage helps companies recover after an unexpected, catastrophic event disrupts operations and damages property inside and / or outside of the business. Commercial property insurance can also be used to help cover repair or replacement costs for stolen, damaged, or destroyed property.

This type of policy is legally binding, meaning the insurance provider must process its insured’s claim and pay what it is rightfully owed for the covered damages promptly. Unfortunately, claims can often be wrongly denied by insurers at the expense of their policyholders. This can put business owners in a difficult position, as they may be unable to run their business as normal or at all due to the extent of the damage. For commercial property owners to avoid these difficult circumstances, they should understand some of the top reasons why commercial property insurance claims are denied. These can include:

A Delay in Filing the Claim

Business owners may be tempted to wait to file an insurance claim for a variety of reasons after property damage occurs. Some owners may want to see if they can complete the repairs themselves, while others may be more concerned with how filing a claim could impact their insurance rates. Regardless, commercial property owners should not wait too long to file a claim.

While most policies state that the insured should notify their insurance company promptly of a loss, the definition of “prompt” can be vague. Despite this ambiguity, policyholders should file a property damage claim as soon as possible because of other time constraints that must be adhered to after a claim is filed. Insureds can run the risk of a claim denial if they report the loss so late that the insurance company will be unable to complete an appropriate investigation.

Insufficient Documentation of the Damage

After a claim is filed, one of the policyholder’s responsibilities is to provide proof of the damages and / or losses to the insurance company. This can include photo and video evidence of the damage as well as any corresponding documentation that supports the claim. Insufficient documentation of the damage to the property or a lack of inventory of the valuable items on or in the property before the loss can quickly lead to an insurance claim being denied.

Damage Excluded from Coverage

Just as with most insurance policies, commercial property insurance comes with its own set of coverage exclusions. This is because no insurance policy will cover the entire property and everything it contains, nor will it provide coverage against every event or source of damage. While each policy is different, most often damage resulting from events like earthquakes, floods, and other more nuanced risks is not covered under a standard commercial policy. Unfortunately, many policyholders are unaware that to cover these events, they need to purchase a separate policy. Without this additional, specific coverage, if the source of property damage is not covered under the existing policy, the claim will be denied.

Not Mitigating Further Damage

Immediately after a commercial property is damaged, it is important that property owners attempt to mitigate further damage. This is one of the key requirements in property damage policies; however, this does not mean the insured should make any permanent repairs to the property. On the contrary, the policyholder must make arrangements to ensure the property doesn’t sustain additional damage while the claim is investigated.

Mitigating damage can include installing tarps over damaged roofs to protect the interior of the property or blocking off the damaged areas of the property to help contain it. If the policyholder does not attempt to prevent further damage to the property, the insurance provider can flat-out deny the claim.

Not Maintaining the Property

Commercial property owners are required to keep up with regular, expected maintenance and repairs to their properties. While insurance protects against any unexpected damage, an insurer expects the property owner to prevent wear and tear-related damage. Wear and tear exclusions keep insurers from being held liable for damage that is foreseen and preventable.

Commercial Property Damage Checklist

Because commercial property damage claims can be denied for a variety of reasons, business owners must ensure every detail of their claim is accounted for. Having a commercial property damage checklist to detail key steps taken before and after a covered event occurs can help to make the claims process a smoother experience and ensure nothing is overlooked. A commercial property damage claims checklist should include the following items:

Before Damage Occurs

- Take photographs of the property: While it may seem like something to only do after the damage has occurred, having photographs on hand of how the property looked at its best will be important evidence in proving the extent of future potential damage. New photos should be taken each year or after any alterations have been made to the property.

- Back up critical information: Ensuring all the business’s records, such as rental and maintenance records, and communication systems are backed up at an offsite location is incredibly important when considering the threat of property damage. This will allow the business to be able to retrieve information regarding clients, finances, and other documents crucial to maintaining ongoing operations should the property damage leave the premises unusable.

- Create a disaster preparedness plan: Discussing a plan of action for what to do if a natural disaster threatens your business can help mitigate some damage and alleviate concerns before damage occurs. This could include cutting master keys to all areas of the property, ensuring any furniture or potentially hazardous items are moved inside, and having an up-to-date emergency contact list.

- Review the insurance policy: Obtaining and reviewing the current insurance policy or policies can help property owners understand their rights and obligations well before damage occurs. This also provides an opportunity to learn what types of damage are and are not covered. Having the assistance of an experienced commercial insurance coverage attorney can aid in understanding the terms of your policy well before you need to use it.

After Damage Has Occurred

- Document all damage: Taking photos and videos of all the damage before cleaning up, filing an insurance claim, or making temporary repairs can help keep the claims process moving. Insurance companies will likely request these items once a claim has been filed, so already having them on hand can keep your claim moving along smoothly. Further, every item has a potential value, so keeping damaged items rather than throwing anything out is useful until the items can be inspected.

- File a commercial insurance claim: Once the damage has been well documented, property owners should file an insurance claim with the insurer. Once the carrier receives the claim and reviews the documentation, it will send an adjuster to review and determine the extent of the damage. It’s important not to make permanent repairs to the property during this time so the adjuster can make an accurate assessment of the damage sustained. Repairing property damage before an adjuster assessment can lead to the claim being denied.

- Protect the property from further damage: While permanent repairs should be avoided before filing an insurance claim and having an adjuster inspection, property owners should take measures to protect their property from further damage loss. This can include putting up tarps over a damaged roof or broken windows, removing wet drywall and carpeting to prevent mold, turning off utilities, securing valuables, and / or boarding up openings to protect the premises from unwanted entries.

- Document all activities and expenses: Maintain a log of all activities and save all receipts for any temporary repairs and abnormal or additional expenses. This documentation should be presented to the insurance carrier to be reimbursed. Additionally, keeping written records of the correspondence with the insurance company can help in the event the claims process is taking longer than normal according to the state’s required time constraints on insurance claims.

When to Seek Legal Counsel for a Denied Claim

If a business owner has taken all the necessary precautions to ensure their covered property damage claim is properly paid out, insurers may still deny it. When this happens and an insurance company fails to fulfill its requirements by law or under the terms of the legally binding policy, it’s in the best interests of the policyholder to obtain legal counsel.

In these cases, insurance providers are often acting in bad faith. Bad faith actions can occur in several ways, such as:

- Failure to pay on time: When the insurer is taking longer than legally allowed to make claim payments without notifying the insured and without making a reasonable effort to pay the claim, then the insurer could be acting in bad faith.

- Unreasonably low payment: When the insurer offers an unreasonably low settlement for a claim, that could be grounds for a bad faith claim. For instance, if a commercial property has $100,000 worth of covered damage and the insurer offers $10,000 to repair it.

- Denying a valid claim: When the insurer denies a claim for a loss that is covered under the terms of the policy, the insurer may be acting in bad faith by attempting to avoid paying out on a claim. Often, insurance companies try to claim a loss is not covered by saying the claim falls under an exclusion, such as general wear and tear.

Commercial Property Insurance Claims Attorneys

Even if a policyholder follows all of the requirements necessary to avoid having a commercial property claim denied, insurance providers can still utilize bad faith tactics to avoid paying a claim. When this happens, hiring experienced legal counsel can make a big difference in the success of a claim. At Raizner Slania, we work to aggressively ensure your commercial property damage insurance claim is properly investigated, that you get the money you are owed by the insurance company, and get your operations up and running as normal.