Businesses of all types are likely to be impacted by minor to major weather events and natural disasters during their time in operation. While owners may be aware of the coverage their commercial property insurance policies offer for these and other unexpected events, many may not consider the effects of wear and tear on a property that happen over time. Regular bouts of heavy rain and hail, for instance, can cause small amounts of damage over time. If left unattended, these small amounts of damage can create big problems for commercial policyholders over time that may not be covered by insurance. For property owners to ensure their livelihoods are protected, they must have a good understanding of the wear and tear exclusion, and how it applied to commercial property insurance claims.

Wear and Tear Exclusion

Owning any type of property comes with the responsibility to maintain it. Everything from landscaping to ensuring the roof is in good working condition are responsibilities that must be taken on once a property is purchased. Despite an owner’s best efforts at property maintenance, however, certain instances of wear and tear can easily go undetected. When this happens, it is not uncommon for commercial property owners to wonder if this type of deterioration will be covered under their commercial property policies.

“Wear and tear” refers to the gradual damage that happens to a home or business over time as the elements naturally take their toll on the property. In some cases, wear and tear is unavoidable due to time and the age of the structure. Despite this, most insurers believe wear and tear can be avoided if the property owner performs all appropriate and routine maintenance on their structure. This type of maintenance often includes attending to roof leaks, slow leaking pipes, and mechanical equipment breakdowns, among others.

In short, instances of wear and tear are most commonly not covered by commercial property insurance. Policy exclusions for wear and tear damage to a property are designed to protect insurers from being held liable for damage occurring due to a policyholder’s failure to maintain, repair, and / or replace any defective or deteriorating portions of the property. Thus, it is the policyholder’s responsibility to ensure their investment is well maintained year-round to avoid any potential damage that could arise due to wear and tear. This can be difficult, as there aren’t always clearly defined standards as to what constitutes wear and tear.

For instance, if a business has a roof over 10 years old that has not been maintained or repaired, it could easily begin leaking and cause damage to the contents inside the property. Because the damage is the result of the owner’s failure to maintain the roof, an insurance claim would likely be denied as it would be considered wear and tear. On the other hand, if the same roof had been regularly inspected and maintained by a roofing company and a windstorm damaged it, the policyholder would be able to prove the damage was the result of a covered event.

While this may seem straightforward, it can quickly become complicated. Insurance companies often rely on insurance adjusters or building engineers to evaluate property damage claims. In certain cases, these experts may not agree with each other as to whether or not wear and tear was present on the property.

Additionally, insurers often cite wear and tear as the cause of damage to avoid having to pay a claim. This is unfortunately common in cases of windstorms and / or flooding, as insurers will attempt to invoke wear and tear and blame the damage on a preexisting condition.

Denied Insurance Claims Due to Wear and Tear

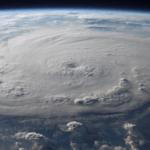

To avoid a contractual payment, many insurance companies will claim damage is the result of wear and tear – even if that is not the case. When there is a natural disaster such as a hailstorm, hurricane, tornado, or flood, insurers will frequently pin the blame for property damage on a preexisting condition. In these types of situations, one of the most common exclusions that insurance companies invoke to deny claims is “wear and tear.”

Other exclusions include poor maintenance, prior damage, manufacturing defects, or faulty installation. A prevalent example involves roof damage claims: insurers often improperly cite the age of the roof or the maintenance record as the cause of damage as opposed to a hailstorm that was responsible for denting or destroying the roof.

The “wear and tear” excuse is also particularly prevalent when assessing aging commercial properties, even if they are in good shape. Many times, the insurance company will inspect the property before selling the insurance policy and these underwriting reports show the property was in acceptable or even good condition; however, the insurance company will still trot out its warhorse excuse that the damage resulted from wear and tear. In these types of situations, the insurance company may be denying the claim improperly, and a false claim by an insurer can often lead to a bad faith insurance lawsuit.

Common Commercial Property Damage Exclusions

Wear and tear damage exclusions are incredibly common in nearly all commercial property insurance policies. Even within an all-risk policy, the named exclusions and limitations defined will ultimately determine if a property loss is covered. Insurance companies may claim that poor maintenance, prior damage, manufacturing defects, and/or faulty installation contributed to wear and tear and thus the claimed loss be excluded from coverage. Other common commercial property policy exclusions include:

Flooding

While commercial property insurance does cover cases of water-related damage, this does not include property damage caused by flooding. The damage that standing water like a flood can cause to a property is much different than regular water damage. For a commercial property to be protected against flood-related instances, a separate commercial flood policy will need to be obtained.

Earthquakes

As with flood insurance, coverage for earthquake damage is typically not included in a commercial property policy. If a business owner owns a property in an area that is prone to earthquakes, an earth movement policy can help to bridge that gap in coverage.

Commercial Auto Accidents

Commercial property policies cover cases of damage to storefronts, warehouses, office buildings, and other brick-and-mortar structures – not commercial vehicles. Insuring a building and a vehicle are two very different things because each type of property can experience vastly different types of damage and perils. While commercial auto and property policies can sometimes be bundled together, they are still two separate policies.

Equipment Breakdown

Insurance is used to cover things that may happen unexpectedly. Similar to wear and tear, equipment breakdown is inevitable over time. So, while an insurer may be more likely to cover new kitchen equipment when a restaurant is damaged in a fire, it will not pay for a new pizza oven just because the existing one is no longer working properly. Because of this, cases of equipment breakdown are most often excluded from coverage under a commercial property insurance policy.

Commercial Property Insurance Claim Attorneys

Damage to commercial property is inevitable; however, keeping an eye out for wear and tear can help better protect your business from a major disaster or weather event. Unfortunately, it is all too common for insurance companies to cite wear and tear damage in response to a claim to benefit their financial interests. When this happens, the policyholder should contact legal counsel.

At Raizner Slania, our commercial property insurance claim attorneys have extensive experience combatting bad faith tactics. This includes violations committed by insurance companies that falsely claim valid property damage was preexisting and/or the result of wear and tear. If your commercial property insurer is attempting to deny a valid claim due to the citing of wear and tear damage, we can help.