Natural disasters of any kind have the potential to strike with little warning. These events can leave businesses with severe damage that can have a great impact on operations if not mitigated promptly. Hotels, in particular, are no stranger to these events and depending on where they are located, can experience vastly different risks.

When a natural disaster or severe weather event is likely to impact a hotel, the business must anticipate the worst, including potential damage to both the exterior and interior of the property. Not only that, but employees and guests alike may have to react quickly to escape a potentially dangerous situation for their safety. Having detailed plans in place can help hotels prepare for potential natural disaster risks and help mitigate damage to people and property.

Hotel Natural Disaster Risks

Understanding how hotels can prepare for certain natural disaster risks is incredibly important for business owners. These particular business models must prepare for an array of potential disaster events depending on where the insured property is located. This is because while the commercial property owner of a hotel chain may be located in California, for example, the insured property may be located on the East or Gulf Coasts. These potential weather events will very likely affect a hotel in Texas differently than they would one located in Massachusetts or Oregon.

Disaster risks experienced regionally by hotels across the United States include:

Texas and Coastal Hotels

In Texas and other coastal states, the risk of a hurricane or tropical storm occurring is higher than elsewhere in the nation, meaning hotels should be prepared for potential water and wind damage. As with Hurricane Harvey, for example, many businesses – including hotels – suffered greatly due to extensive water and flood damage from the storm, leaving many with no option other than to close entirely.

With hurricanes and tropical storms, hotel owners should be cognizant of on-site pools, sidewalks, and paved surfaces. Owners must ensure the business has appropriate commercial insurance coverage for any potential wind and flood damage. Because of coverage limitations and exclusions, typical insurance plans may only cover damage to the building itself and not to any of the property’s landscaping, its foundation, and/or underground piping and plumbing.

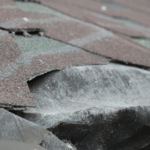

Hail is also a concern for Texas commercial property owners. Hotel and business owners in hail-prone areas can look into installing protective measures such as hail guards, which are installed on roofs to protect the roofing materials, air conditioning systems, and other important items located on top of the building from damage.

West Coast Hotels

Despite being located in another coastal region, disasters that are common to California and other states on the West Coast are quite different from those experienced in southern states. For instance, these states often see disasters in the form of earthquakes and wildfires. In recent years, California has experienced several devastating wildfires that have ravaged portions of the state. With extreme cases like these, it is important to ensure hotels located in these areas have extensive fire damage coverage.

Unfortunately, however, hotels located in these wildfire-prone areas have found that insurance carriers have pushed back against writing coverage due to these particular dangers. Some insurers may write policy exclusions into insurance policies such that if a hotel or property caught fire due to brush being nearby, the carrier would not cover any fire damage stemming from the incident.

Northern Hotels

In northern states like New York and Illinois, the potential for heavy snow is all too common. If a hotel is preparing for a snowstorm or deep freeze event, owners should ensure the business’s pipes are protected from potentially freezing and bursting. Burst pipes could cause a great amount of water damage to the interior of the property.

How to Mitigate the Impact of a Natural Disaster

Because hotels can experience a wide array of disaster risks depending on where they are located, it is incredibly important they have some sort of disaster response plan in place for natural disasters and other potential large-scale threats. A comprehensive disaster response plan can help mitigate the overall impact a natural disaster has on a hotel, its staff, and its guests. Some of the most important aspects to account for in these disaster response plans include:

Safety of Staff and Guests

The top concern of any disaster response plan is ensuring the safety of guests and employees. In instances of fire, plans should include moving guests away from areas compromised by flames, heat, and smoke. For instances of flooding, guests and staff should remain clear of areas that have been inundated with water. These areas could be incredibly dangerous if they have exposed wiring or objects employees and guests alike could be injured by that they may not be able to see.

Well-marked evacuation routes should be placed throughout a hotel to help others navigate to safety quickly and efficiently. Emergency services should also be contacted as soon as possible for additional assistance; however, owners should keep in mind that depending on how far-reaching the disaster is, it could impair the ability of emergency personnel to respond.

Operational and Business Concerns

A disaster response plan should also include the protection of sensitive and valuable information. Smaller, family-owned hotels and motels may not be able to afford to be closed for as long of a duration as major hotel chains can. Securing and keeping duplicates, as well as digital records of important company records and customer information can help the business more easily recover.

In addition to this, hotel owners should consider purchasing a business interruption insurance plan. These policies work in tandem with standard commercial property damage policies to help a business recover financially if it has to shut down completely or is inoperable for some time.

Training

Disaster response plans have the best chance of being successful if the proper training is conducted before any type of emergency occurs. Ensuring staff members know what exactly is expected of them in the case of a disaster can help them to be better prepared for these high-stress situations. Effective disaster response training should include delegated tasks of employees, taking into account certain safety measures, as well as knowing where emergency exits and emergency alarms are located.

Natural Disaster Commercial Property Insurance Claims

While hotel and other commercial property owners should be well prepared for potential natural disasters, accounting for an underpaid, delayed, or denied insurance claim to help repair any damage sustained is often not top of mind. In these instances, being faced with a wrongly denied insurance claim can only lead to more frustration and ongoing losses of revenue for the owner.

Since commercial property insurance is in many cases required to protect the livelihood of a business, carriers that deny, delay, or underestimate the value of commercial property damage claims are doing policyholders a huge disservice. If a hotel sustained damage covered by its policy, but the insurance company won’t pay the claim, the business owner should enlist the help of an experienced commercial property damage insurance claims attorney.

Hotel Property Damage Claims Attorney

Hotel property damage claims that arise after a natural disaster or severe weather event can be detrimental to ongoing day-to-day operations for business owners and even cause permanent damage and loss. At Raizner Slania, we understand just how upsetting these instances can be, particularly if a valid claim has been wrongly denied. Our trial attorneys have represented various hotel and motel owners all across Texas and around the nation in complex insurance cases and we understand how insurance companies function. If your hotel or commercial property has been denied coverage for a valid insurance claim, we can help you recover what you are rightfully owed under your policy. Contact our office today to see how we can best assist you.