Raizner Slania LLP has filed an insurance lawsuit on behalf of commercial property owners in Hidalgo County, Texas (“Plaintiffs”) against Homesite Insurance Company, Progressive Home Advantage, and their adjuster (collectively “Defendants”). The lawsuit was necessary due to the wrongful rejection of the Plaintiffs’ property damage claim.

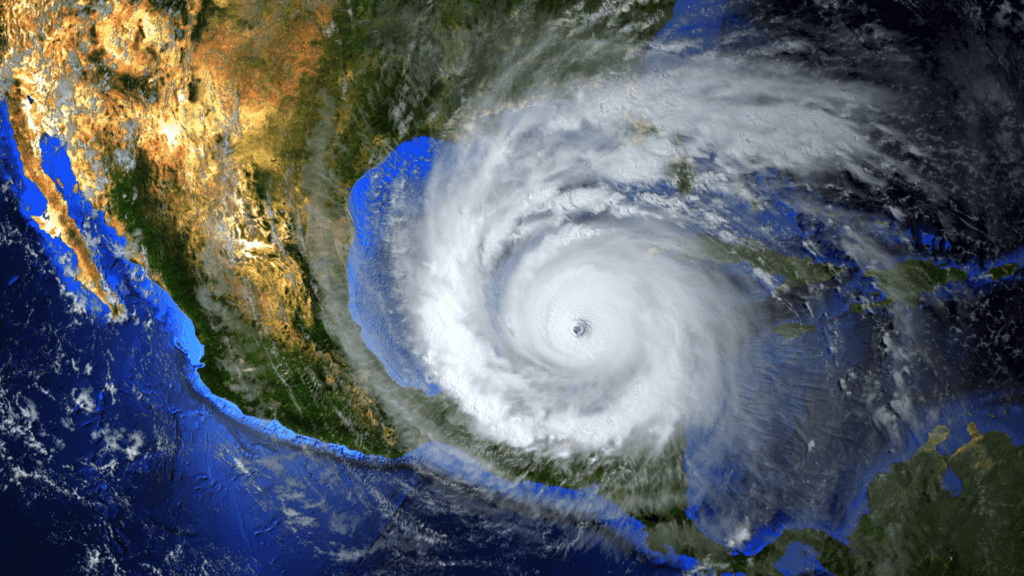

Hurricane Hanna Damages the Property

On July 25, 2020 Hurricane Hanna caused substantial damage to the Hidalgo County property. Sizeable portions of the property – especially the windows – were compromised; and, as a result, there was substantial damage to the interior of the property. After the storm, Plaintiffs promptly filed a claim with their insurance carriers, alerting them to the extensive damage.

The insurance carriers’ claim-handling process omitted a wealth of facts, physical evidence, obvious damage, and meteorological data, which resulted in a wrongful refusal to pay damages. The carriers unreasonably undervalued and underpaid the loss, a tactic designed to save insurance companies millions of dollars rather than pay out valid damages claims like the one for the subject property.

The carriers assigned an adjuster from Pacesetter Claim Service to be the lead adjuster to handle the claim. She was unqualified, incapable of adequately assessing the damage to this type of commercial property, and caused many delays throughout the claims process. Defendants continued to delay the claim resolution and failed to provide Plaintiffs with answers.

The adjuster inspected the property and acknowledged the damage from wind driven rain, but grossly undervalued it. The insurance carriers relied upon the adjuster’s opinion for their coverage decision. Despite the clear evidence of covered damage, the insurance carriers engaged in and ratified this improper claim conduct and ultimately sent a letter on September 7, 2020 declining to issue a payment. Defendants unreasonably blamed the loss on causes other than Hurricane Hanna in an effort to avoid their contractual responsibilities and to save themselves significant sums of money.

To date, Defendants, in concert with and at the direction of the adjuster, have failed to issue payments owed under the policy.

Plaintiffs Send Demand Letter

On June 1, 2017, Governor Abbott signed House Bill 1774 into law as Section 542A of the Texas Insurance Code. Section 542A.003 requires detailed, comprehensive pre-suit notice that is intended to make the claims and litigation processes more transparent and potentially even avoid unnecessary lawsuits. Upon receiving notice, an insurer has a right to conduct an inspection, and even make an offer to avoid litigation. When utilized properly, Section 542A should assist business owners like Plaintiffs in avoiding protracted litigation over a clear claim.

In compliance with Section 542A.003, Plaintiffs gave the required pre-suit notice to Defendants on September 8, 2021. The pre-suit notice provided a comprehensive outline of Plaintiffs’ claim and damages, quantified the loss, and even offered to waive a formal claim for attorneys’ fees if the contractual amounts were paid promptly. The Defendants responded, but denied any wrongdoing.

The Defendants Violated the Texas Insurance Code

In addition to the actions mentioned herein, Plaintiffs specifically allege Defendants violated the Texas Insurance Code by:

- Failing to attempt to effectuate a prompt, fair, and equitable settlement of a claim with respect to which liability has become reasonably clear;

- Failing to adopt and implement reasonable standards for prompt investigation of claims arising under its policies ;

- Failing to provide promptly a reasonable explanation, in relation to the facts or applicable law, for the denial of a claim;

- Refusing to pay the claims without conducting a reasonable investigation with respect to the claims ;

- Misrepresenting the insurance policies under which they afford property coverage to Plaintiffs;

- Misrepresenting the insurance policies under which they afford property coverage to Plaintiffs by failing to state a material fact that is necessary to make other statements made not misleading ;

- Misrepresenting the insurance policies under which they afford property coverage to Plaintiffs by making a statement in such manner as to mislead a reasonably prudent person to a false conclusion of material facts and failing to disclose a matter required by law to be disclosed;

- Knowingly committing the foregoing acts, with actual knowledge of the falsity, unfairness, or deception of the foregoing acts and practices;

- Failing to acknowledge receipt of the claim;

- Failing to timely commence investigation of the claim or to request from Plaintiffs any additional items, statements or forms that Defendants reasonably believe to be required from Plaintiffs ;

- Failing to notify Plaintiffs in writing of the acceptance or rejection of the claim not later than the 15th business day after receipt of all items, statements and forms required by Defendants; and

- Delaying of payment of Plaintiffs’ claim.

The Plaintiffs also made claims for statutory interest penalties along with reasonable attorneys’ fees, alleging the carriers breached their contract, breached their duty of good faith and fair dealing, and violated the Texas Deceptive Trade Practices Act (DTPA).

Insurance Coverage Attorneys

If you own a commercial property that has suffered damage and your claim has been wrongfully delayed, grossly underpaid, or denied, the experienced team of insurance coverage attorneys at Raizner Slania can help. Contact us today to see how we can best assist with your claim.