Raizner Slania LLP has filed an insurance lawsuit on behalf of a Harris County apartment complex against AmRisc LLC, CRC Insurance Services Inc., and Highpoint Insurance Group LLC (the “Defendants”). The lawsuit involves an arbitration clause in the apartment complex’s insurance policy that both AmRisc, CRC, and Highpoint failed to disclose.

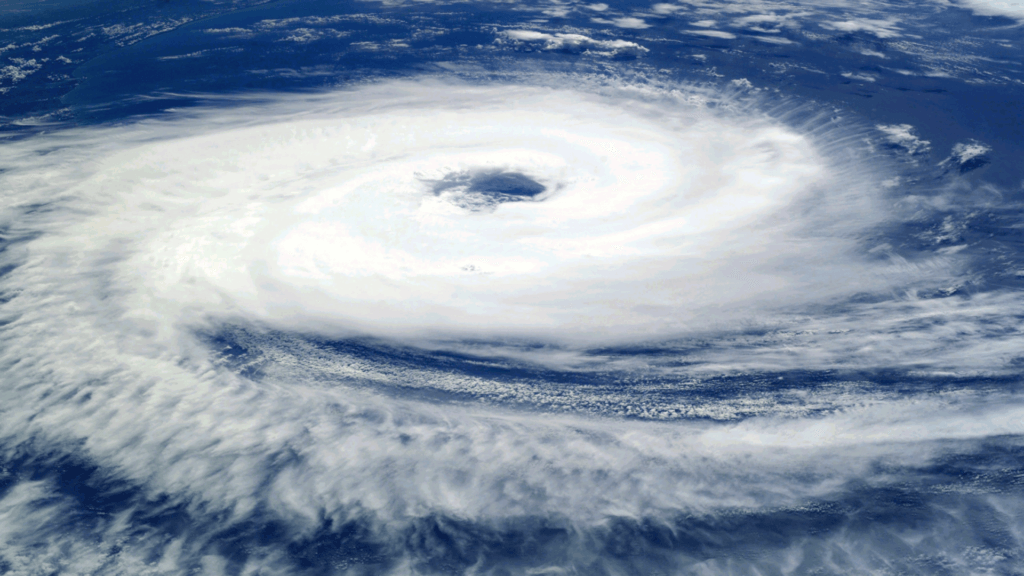

Hurricane Harvey Causes Significant Damage to the Apartment Complex

Highpoint was plaintiff’s insurance agent. It sought coverage for the plaintiff’s property, and ultimately obtained a quote from AmRisc. AmRisc is believed to have connected with CRC, a wholesale broker for insurance companies, to obtain a policy for the plaintiff. The policy was ultimately bound, with property coverage provided by several different insurers.

On August 27, 2017, Hurricane Harvey struck the plaintiff’s property, causing significant damage to the apartment complex. Two days following the hurricane, the plaintiff filed an insurance claim with its agent Highpoint.

Nearly a year passed without any substantive progress and zero payment on the plaintiff’s claim. In December 2018, the insurance carriers providing coverage under the complex’s policy made a partial “advance” payment to the plaintiff. On June 3, 2019, the Carriers, through AmRisc’s handpicked adjuster CJW, sent the plaintiff a letter officially refusing any additional payment on the claim. Faced with the certainty of recovering nothing for the significant damage inflicted to the property and business, the plaintiff retained Raizner Slania LLP to represent it. Raizner Slania sent a demand letter to the insurance carriers, who responded through counsel. Much to the plaintiff’s surprise, the carriers demanded arbitration, citing an arbitration clause within the plaintiff’s policy.

AmRisc never disclosed the existence of the Arbitration Clause and it was not disclosed in the detailed quotation AmRisc provided to plaintiff’s agent in May of 2017. It was not part of the package AmRisc required Plaintiff to sign in order to bind coverage and it was not part of a confirmation sent by CRC. Simply, the plaintiff never agreed to the arbitration clause.

The carriers have still not paid the plaintiff for its insurance claim, now more than more than 1,000 days after the property was damaged. The plaintiff reluctantly proceeded with arbitration with the Carriers under the terms it never agreed to, and is currently incurring significant monetary and time costs associated with hiring lawyers to represent them in the arbitration – in addition to the time and money already spent.

The Carriers Acted in Bad Faith

Our client sues the Defendants based on their failure to disclose or even reference the existence of the arbitration clause. We allege multiple violations of the Texas Insurance Code, including:

- Misrepresentation of the policy by making an untrue statement of material fact

- Misrepresentation of the policy by failing to state a material fact that is necessary to make other statements made not misleading

- Failure to inform the plaintiff, prior to binding of the policy, of the arbitration clause, choice of law clause, choice of venue clause that have directly led to the deprivation of plaintiff’s legal rights and subsequent damages

- Misrepresentation of the terms of the policy by making a statement in such manner as to mislead a reasonably prudent person to a false conclusion of material fact, and failing to disclose a matter required by law to be disclosed

- Actively, willfully, and purposely concealing any reference to the arbitration provision in the policy

- Failure to conduct a diligent effort to place insurance with a domestic carrier as is required

- Purposefully structuring a program that was designed to circumvent Texas statutory laws regarding governance by Texas law

- Failure to inform plaintiff of the arbitration clause, choice of law clause, choice of venue clause that have directly led to the deprivation of plaintiff’s legal rights and subsequent damages

- Knowingly committing the foregoing acts, with actual knowledge of the falsity, unfairness, or deception of the foregoing acts and practices

The plaintiff additionally alleged the Defendants fraudulently concealed the arbitration clause within the contract, engaged in a civil conspiracy to commit fraud, committed negligence, and breached their duties to obtain appropriate insurance coverage for the plaintiff.

Texas Insurance Coverage Attorneys

If you are the owner of a Houston apartment complex or a commercial property and your hurricane insurance claim was wrongfully denied or grossly underpaid, the Texas insurance coverage attorneys at Raizner Law can help. Contact us today for a free consultation to review your case.