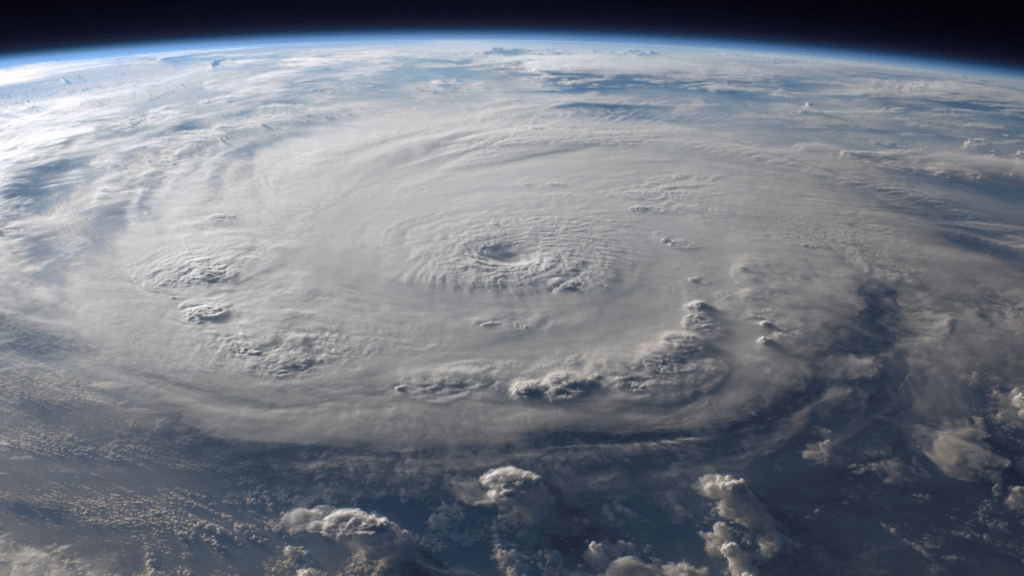

Why Hurricanes Pose Property Damage Concerns For Inland Communities

It’s no secret that an incoming hurricane poses a major threat to those in coastal communities. These powerful storms can cause devastating storm surges and heavy rain that can result…