NCAA CONCUSSION CASES

Raizner Slania represents many clients in concussion-related lawsuits against the NCAA, universities, and athletic conferences. We represent former student athletes, primarily college football players, suffering from brain injury conditions including CTE, Parkinson’s, Alzheimer’s, and more.

Our clients allege universities, athletic conferences, and the NCAA ignored obvious dangers of concussions, failed to warn players of the risks, and encouraged players to continue to play even after they suffered from sports-related concussions. Earlier this year, a federal judge proposed a settlement in related litigation against the NCAA on behalf of all college athletes. While the court-approved settlement included new safety protocols, it did not compensate former players struggling with brain disorders. In contrast, when retired players sued the NFL, it reached an agreement worth hundreds of millions of dollars in payments to help those suffering from a list of neurological diseases.

SYMPTOMS

Brain trauma can cause many symptoms in different individuals. Some players may develop and display symptoms from a few acute concussions that manifest differently in a player with only one documented concussion. There is no exact science to brain trauma. Below are conditions reported in players with brain trauma:

- Rage

- Impulsivity

- Depression

- Confusion

- Memory Loss

- Dementia

- Challenges in problem solving

- Difficulty completing familiar tasks

- Trouble understanding visual images

- New problems with words

- Misplacing things

- Decreased or poor judgement

- Withdrawal from work or social activities

- Changes in mood

- Tremor

- Bradykinesia

- Rigid muscles

- Impaired posture or balance

- Loss of automatic movements

- Changes in gait

- Abnormal fatigue of the appendages

- Breathing difficulties

- Changes in vocal pitch

- Difficulty grasping or lifting objects

- Dropping things

- Muscle cramps and twitches

- Slurred speech

- Tripping

- Uncontrollable laughter or crying

INJURIES

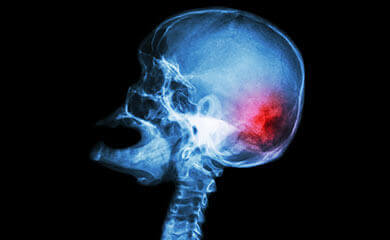

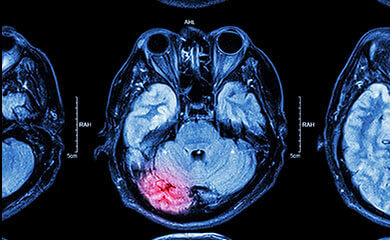

Chronic Traumatic Encephalopathy – CTE

Chronic traumatic encephalopathy (CTE) is a progressive degenerative disease that affects the brains of people who have suffered repeated concussions and traumatic brain injuries, such as athletes who participate in contact sports. CTE is not just about concussions – many researchers believe the condition is a result of repeated hits to the head. Each time the player’s head is impacted, it shakes the brain inside the skull, building up the abnormal tau protein.

Alzheimer's Disease

Alzheimer’s Disease is the most common form of dementia, and it causes problems with a person’s mental faculties and behavior. Symptoms usually develop slowly and get worse over time, a progressive disease, where dementia symptoms gradually worsen over a number of years. In its early stages, memory loss is mild, but with late-stage Alzheimer’s, individuals lose the ability to carry on a conversation and respond to their environment.

Parkinson's Disease

Parkinson’s Disease is a progressive nervous system disorder that affects movement by altering nerve cells in the brain that produce dopamine. It develops gradually, and its symptoms worsen as a patient’s condition progresses over time. You should see a doctor if you have any of the symptoms associated with Parkinson’s.

ALS – Lou Gehrig’s Disease

ALS, or amyotrophic lateral sclerosis, is a progressive neurodegenerative disease that affects the brain and spinal cord. There are two different types of ALS, sporadic and familial – sporadic is the most common (90-95% of cases) and can affect anyone, familial means the disease is inherited genetically. ALS usually affects people between the ages of 40 and 70. One of the most famous individuals diagnosed with ALS is baseball legend Lou Gehrig, causing some to nickname the condition Lou Gehrig’s Disease.

Early-Onset Dementia

Dementia is not actually a disease, but is a collection of symptoms that can be caused by other diseases. It is a general term denoting a decline in mental ability severe enough to interfere with one’s daily life. Dementia symptoms include impairments in thinking, attention, communicating, visual perception, and memory. While the leading cause of dementia is Alzheimer’s disease (60-80%), dementia can also be caused by brain damage incurred from an injury.

Neurocognitive Impairment

Cognition is the act of knowing or thinking. It includes the ability to choose, understand, remember and use information. A problem with any one of these aspects of cognition is neurocognitive impairment. Disturbances of attention, memory, and executive functioning are the most common neurocognitive consequences. A head injury, traumatic brain injury (TBI), brain injury, or other head trauma can affect cognition.

STATISTICS

FAQS

Can I participate in the NCAA class action settlement and pursue my own claim for concussion injuries?

Yes. The pending class action settlement is limited to medical monitoring. It does not preclude an individual claim for personal injuries. It does not even preclude class action cases where claims are pursued on behalf of a group that played a single sport at a school. Because the settlement simply does not impact these types of injury claims, you do not need to opt out of the medical monitoring class settlement. Instead, if you wish to pursue a claim for your own injuries, either individually or as a representative of other former football players at your school, you can contact us for a free evaluation. Class action settlements can be confusing, and we understand the uncertainty they can produce. We are available to answer your questions, and if you qualify, to pursue a concussion injury claim on your behalf.

How do I know if I have suffered a concussion?

A concussion is a traumatic brain injury that results from a blow to the head, disrupting brain function. The general symptoms of concussion can include headaches, neck pain, difficulty concentrating, slowed speech, getting easily confused, ringing in the ears, increased sensitivity to lights and sound, mood changes, changes in sleep, and more. It is best to take a bump on the head seriously and seek medical treatment in case your condition is more serious than you realize.

Am I qualified to file a lawsuit?

A person will be potentially qualified to file an NCAA concussion lawsuit if:

- You or a family member attended an NCAA school

- The student played sports

- The student-athlete suffered a concussion

- As a result of this head injury, the student-athlete has lasting health complications

Are the NCAA lawsuits the same as the NFL concussion lawsuits?

The NFL concussion lawsuits resulted in an agreement between the NFL and a group of retired football players that included the payment of hundreds of millions of dollars for several neurological conditions. The previous NCAA class action only achieved new safety protocols but did not obtain any financial compensation for student-athletes. In these newly filed cases, the NCAA concussion plaintiffs are claiming that universities, conferences, and the NCAA were all negligent in handling head injuries, and so they are now seeking financial compensation for concussions sustained in their college athletic careers.

The NFL has agreed to pay $765 million to fund medical exams, concussion-related compensation, medical research for retired NFL players and has set up protocols for concussions and suspected concussions while slashing practice time, all to prevent head injuries. The NCAA’s silence now means collegiate players are taking more risks and likely suffering more injuries than their professional counterparts.

Why should I hire Raizner Slania?

The experienced legal team of Raizner Slania lawyers has achieved significant results across the country in complex injury litigation. We believe in our clients and in our own track record of success, and so we handle all of our cases on a contingency fee basis – this means you will owe us nothing unless we win your case.

Our lawyers have the intellectual strength and our firm has the financial resources necessary to handle broad, complex litigation against large defendants like the NCAA and win – we have done it before against most major insurance carriers, large maritime employers, and pharmaceutical and medical device manufacturers.

Your family’s financial future may depend on how skilled your NCAA concussion lawyer is, and how hard he or she will work for you. The NCAA presents itself as a protector of student-athletes, yet the organization remains silent on the issue of player safety. We would be honored if you would let us help you hold the responsible parties accountable for causing your concussion-related injuries.

CONTACT US

Have you or someone you love suffered from head injuries caused by sports-related concussions? Find out if you are qualified for a settlement today.